Welcome to the future of

risk assessment

Empower underwriters and supercharge risk engineers with seamless AI integration

The next-generation risk assessment toolkit for commercial insurers:

Team analytics

Client improvement tracking

Evidence manager

Instant regulatory checks

Report versioning

Nat-cat risk analysis

3rd party data integration

Smart prioritisation

Project dashboard

Calendar and scheduling tools

Team analytics

Client improvement tracking

Evidence manager

Instant regulatory checks

Report versioning

Nat-cat risk analysis

3rd party data integration

Smart prioritisation

Project dashboard

Calendar and scheduling tools

Team analytics

Client improvement tracking

Evidence manager

Instant regulatory checks

Report versioning

Nat-cat risk analysis

3rd party data integration

Smart prioritisation

Project dashboard

Calendar and scheduling tools

Backed by investors from

BENEFITS

Transform your workflow

Enhance underwriting decisions, streamline on-site inspections, and ensure data security, all in one powerful platform.

Empower underwriters

nettle’s AI synthesises internal and external data, enhancing underwriter-led desktop risk assessments with actionable insights.

Empower underwriters

nettle’s AI synthesises internal and external data, enhancing underwriter-led desktop risk assessments with actionable insights.

Empower underwriters

nettle’s AI synthesises internal and external data, enhancing underwriter-led desktop risk assessments with actionable insights.

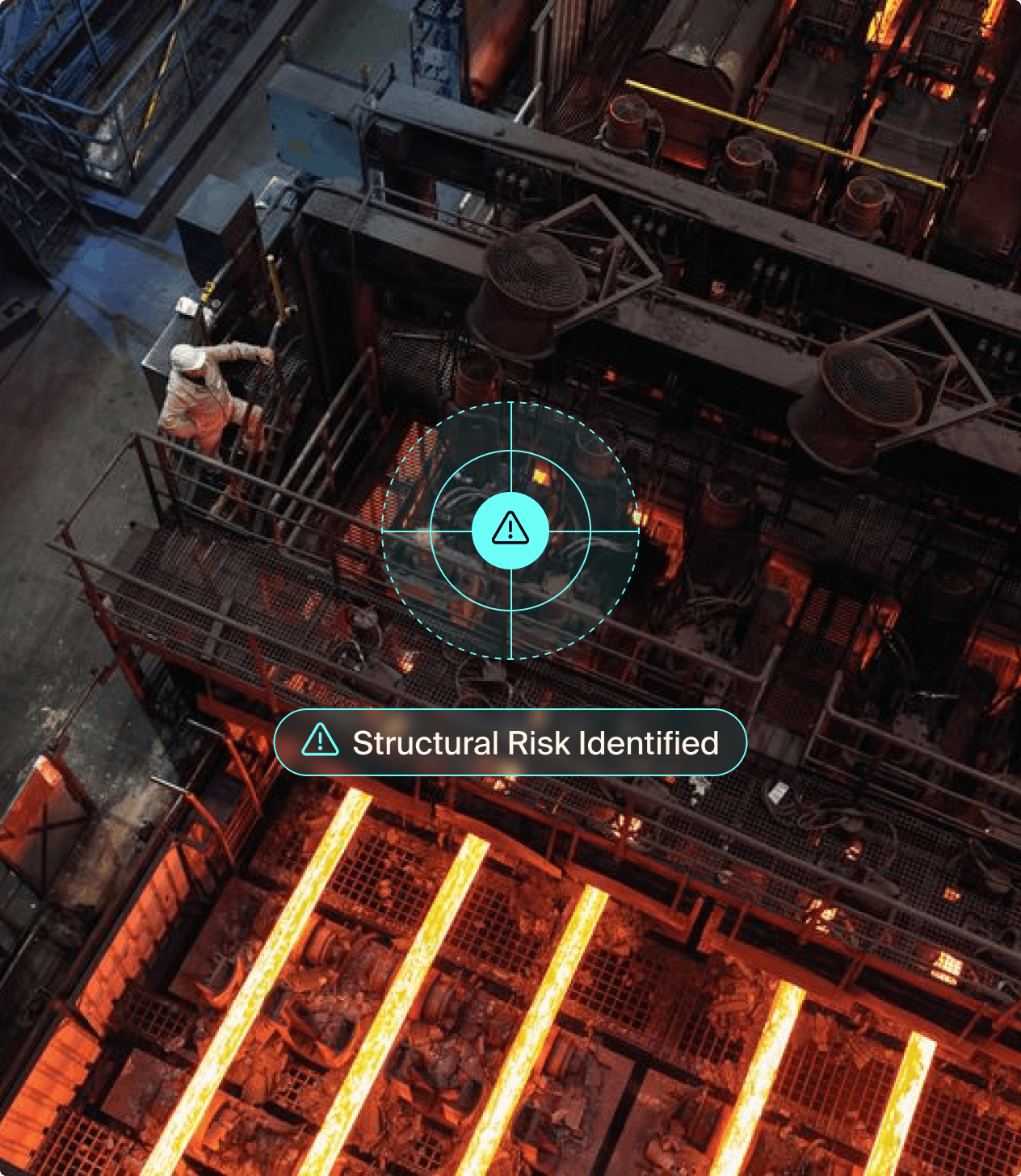

Supercharge risk engineers

Streamline inspections with centralised scheduling, AI-powered tools, and instant report generation, making on-site visits more efficient than ever.

Supercharge risk engineers

Streamline inspections with centralised scheduling, AI-powered tools, and instant report generation, making on-site visits more efficient than ever.

Supercharge risk engineers

Streamline inspections with centralised scheduling, AI-powered tools, and instant report generation, making on-site visits more efficient than ever.

Underwrite faster, with better insights

Let AI handle the heavy lifting by analysing data, photos, and voice memos to create detailed inspection reports—reducing human error and boosting decision accuracy.

Underwrite faster, with better insights

Let AI handle the heavy lifting by analysing data, photos, and voice memos to create detailed inspection reports—reducing human error and boosting decision accuracy.

Underwrite faster, with better insights

Let AI handle the heavy lifting by analysing data, photos, and voice memos to create detailed inspection reports—reducing human error and boosting decision accuracy.

Ensure security and compliance

Protect sensitive data and meet local regulations with nettle’s secure platform, fully ISO 27001 compliant and hosted on regional servers for peace of mind.

Ensure security and compliance

Protect sensitive data and meet local regulations with nettle’s secure platform, fully ISO 27001 compliant and hosted on regional servers for peace of mind.

Ensure security and compliance

Protect sensitive data and meet local regulations with nettle’s secure platform, fully ISO 27001 compliant and hosted on regional servers for peace of mind.

Request Demo

See nettle in action

Schedule a personalized demo today and experience firsthand how nettle can help your team save time, reduce errors, and drive growth.

FAQs

Get answers to common questions about how nettle can enhance your risk engineering and underwriting operations.

Is nettle suitable for teams of all sizes?

Yes, whether you're a large organisation or a small team, nettle scales to meet your needs. Its streamlined platform improves efficiency across teams, no matter the size.

Is nettle suitable for teams of all sizes?

Yes, whether you're a large organisation or a small team, nettle scales to meet your needs. Its streamlined platform improves efficiency across teams, no matter the size.

Is nettle suitable for teams of all sizes?

Yes, whether you're a large organisation or a small team, nettle scales to meet your needs. Its streamlined platform improves efficiency across teams, no matter the size.

Is nettle secure?

Absolutely. Security is a top priority at nettle. Our platform employs industry-leading encryption, strict access controls, and rigorous compliance measures to protect your data at all times. We’re proud to be ISO/IEC 27001 certified - the globally recognised standard for information security management - which reflects our ongoing commitment to the highest levels of data protection and risk management. We also undergo regular security audits to ensure our practices remain robust and up to date.

Is nettle secure?

Absolutely. Security is a top priority at nettle. Our platform employs industry-leading encryption, strict access controls, and rigorous compliance measures to protect your data at all times. We’re proud to be ISO/IEC 27001 certified - the globally recognised standard for information security management - which reflects our ongoing commitment to the highest levels of data protection and risk management. We also undergo regular security audits to ensure our practices remain robust and up to date.

Is nettle secure?

Absolutely. Security is a top priority at nettle. Our platform employs industry-leading encryption, strict access controls, and rigorous compliance measures to protect your data at all times. We’re proud to be ISO/IEC 27001 certified - the globally recognised standard for information security management - which reflects our ongoing commitment to the highest levels of data protection and risk management. We also undergo regular security audits to ensure our practices remain robust and up to date.

Can nettle integrate with our existing tools?

Yes, nettle is built with seamless integration in mind. Our platform supports API connectivity, allowing you to integrate with existing underwriting software, risk assessment tools, and data management systems to create a smooth, unified workflow.

Can nettle integrate with our existing tools?

Yes, nettle is built with seamless integration in mind. Our platform supports API connectivity, allowing you to integrate with existing underwriting software, risk assessment tools, and data management systems to create a smooth, unified workflow.

Can nettle integrate with our existing tools?

Yes, nettle is built with seamless integration in mind. Our platform supports API connectivity, allowing you to integrate with existing underwriting software, risk assessment tools, and data management systems to create a smooth, unified workflow.

How does nettle improve collaboration?

nettle offers instant translation into multiple languages and centralises risk assessment data, streamlining communication and automating key processes. With real-time insights and shared workspaces, underwriters, risk engineers, and compliance teams can collaborate seamlessly, whether they're in the same office or across the globe.

How does nettle improve collaboration?

nettle offers instant translation into multiple languages and centralises risk assessment data, streamlining communication and automating key processes. With real-time insights and shared workspaces, underwriters, risk engineers, and compliance teams can collaborate seamlessly, whether they're in the same office or across the globe.

How does nettle improve collaboration?

nettle offers instant translation into multiple languages and centralises risk assessment data, streamlining communication and automating key processes. With real-time insights and shared workspaces, underwriters, risk engineers, and compliance teams can collaborate seamlessly, whether they're in the same office or across the globe.

How does nettle ensure compliance with local regulations?

nettle is designed to align with industry regulations and compliance standards across multiple regions. Our platform supports insurers in maintaining accurate records, meeting reporting obligations, and implementing best practices to adapt to evolving regulatory requirements. As an ISO/IEC 27001 certified company, we adhere to internationally recognised standards for information security management - further reinforcing our commitment to data integrity, risk management, and regulatory compliance.

How does nettle ensure compliance with local regulations?

nettle is designed to align with industry regulations and compliance standards across multiple regions. Our platform supports insurers in maintaining accurate records, meeting reporting obligations, and implementing best practices to adapt to evolving regulatory requirements. As an ISO/IEC 27001 certified company, we adhere to internationally recognised standards for information security management - further reinforcing our commitment to data integrity, risk management, and regulatory compliance.

How does nettle ensure compliance with local regulations?

nettle is designed to align with industry regulations and compliance standards across multiple regions. Our platform supports insurers in maintaining accurate records, meeting reporting obligations, and implementing best practices to adapt to evolving regulatory requirements. As an ISO/IEC 27001 certified company, we adhere to internationally recognised standards for information security management - further reinforcing our commitment to data integrity, risk management, and regulatory compliance.